Introduction

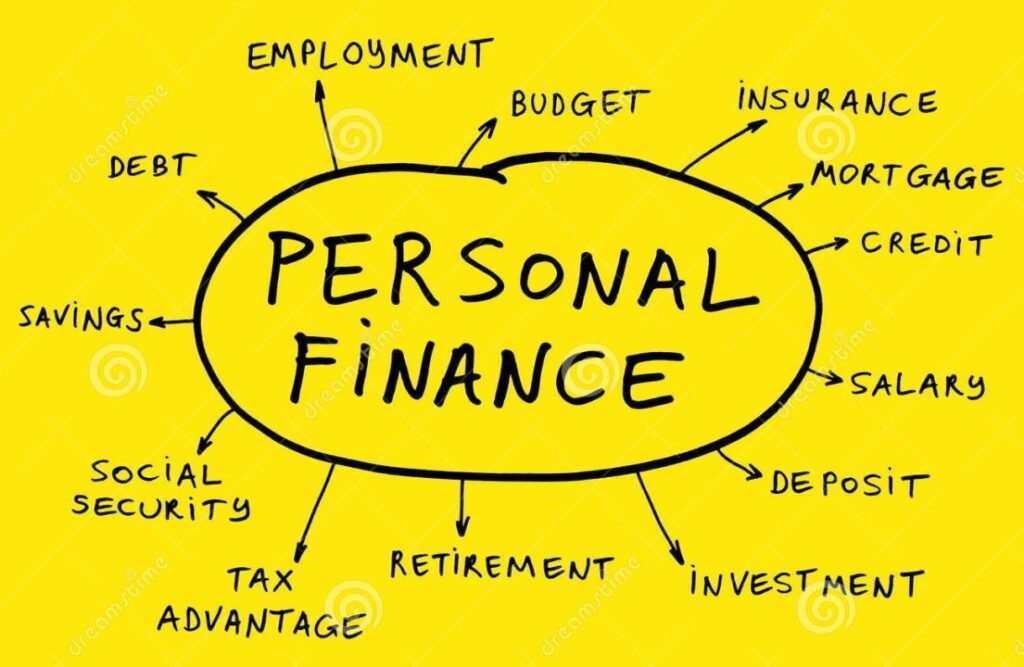

Getting started with personal finance can feel overwhelming, especially when you’re new to budgeting, saving, and managing money. But the good news is that mastering your finances doesn’t require a finance degree — just a few smart, simple strategies. In this guide, we’ll explore the best personal finance strategies for beginners to help you take control of your money and start building a secure future.

Understand Where Your Money Is Going

The first step in managing your personal finances is tracking your expenses. Beginners often overlook this, but it’s one of the most powerful financial strategies you can adopt. Use a spreadsheet, mobile app, or even a notebook to monitor everything — from your rent and bills to your coffee and online subscriptions.

By analyzing your monthly spending, you’ll easily spot areas where you’re overspending and where you can cut back.

Create a Realistic Budget

One of the best personal finance strategies for beginners is budgeting. A well-crafted budget gives your money direction. Start by calculating your monthly income, then subtract fixed expenses like rent, utilities, and loan payments. Whatever’s left should be divided between savings, emergency funds, and flexible spending.

Try using the 50/30/20 rule:

- 50% for needs

- 30% for wants

- 20% for savings/debt repayment

This method ensures balance while still prioritizing financial growth.

Build an Emergency Fund

An emergency fund is your financial safety net. Life can throw unexpected expenses at any time — car repairs, medical bills, or job loss. Ideally, beginners should aim to save 3–6 months’ worth of living expenses in a separate, easily accessible savings account.

Start small — even $20 a week adds up — but make it a non-negotiable habit.

Pay Off High-Interest Debt First

One of the most damaging things to your finances is high-interest debt — especially credit card debt. Beginners should focus on paying off these debts as quickly as possible. Use either the snowball method (paying smallest debts first) or avalanche method (highest interest first), whichever motivates you more.

Debt repayment reduces financial stress and improves your credit score over time.

Automate Your Savings

One underrated but incredibly effective strategy is automation. Set up automatic transfers from your checking account to your savings account each time you get paid. This way, you “pay yourself first” before spending on anything else.

It also makes saving consistent and removes the temptation to skip a deposit.

Start Investing Early

While saving is important, investing helps your money grow over time. Thanks to compounding interest, even small investments can turn into significant wealth over the years. As a beginner, consider starting with:

- Index funds

- ETFs (Exchange Traded Funds)

- Robo-advisors

You don’t need to be an expert — just start small and learn as you go.

Learn to Differentiate Wants vs Needs

Impulse buying is the enemy of financial health. Beginners often struggle to say no to things they “want” but don’t “need.” Before any purchase, ask yourself:

“Do I really need this, or do I just want it?”

Delaying purchases by 24 hours or setting a monthly “fun budget” can prevent overspending.

Use Credit Responsibly

Credit cards can be useful tools if used correctly. They help build your credit score, provide rewards, and offer fraud protection. But misuse leads to long-term debt.

Only charge what you can afford to pay off in full each month. Always pay on time, and never use more than 30% of your credit limit.

Educate Yourself Regularly

One of the best personal finance strategies for beginners is continuous learning. The world of money is always evolving — from tax changes to new investment opportunities. Read personal finance blogs, watch videos, listen to podcasts, and follow experts who share practical tips.

Knowledge is a financial asset that keeps growing.

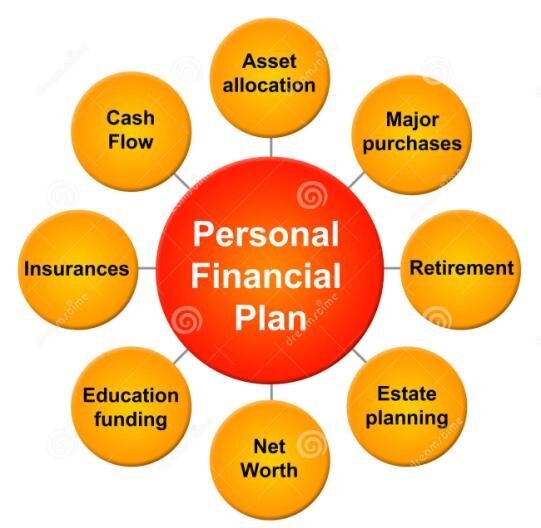

Set Short and Long-Term Goals

Having goals keeps you motivated. Whether it’s saving for a vacation, buying a car, or retiring early, write down your financial goals and create a plan to achieve them.

Break big goals into smaller steps. For example, instead of saying “I want to save $5,000,” start with “I’ll save $200 a month.”

Final Thoughts

The journey to financial freedom doesn’t require perfection — just progress. By following the best personal finance strategies for beginners, you can avoid common pitfalls, grow your savings, and reduce financial stress.

Remember: Every smart decision you make today lays the foundation for a better tomorrow.