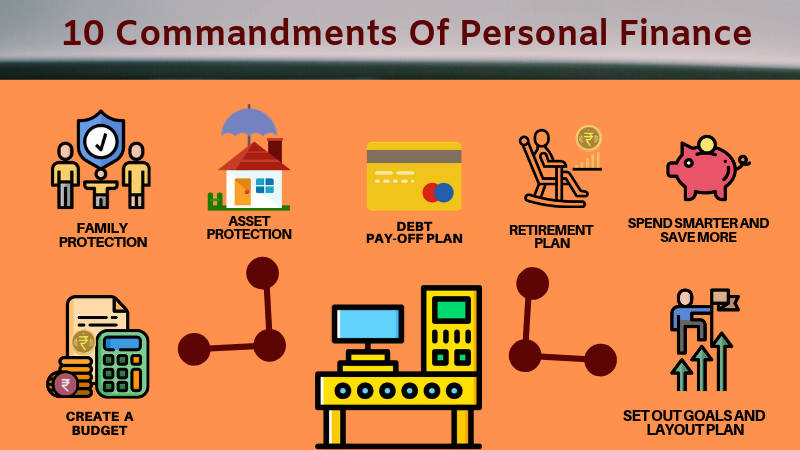

Introduction to Personal Finance Tips

Saving money has never been more important — especially in a time when inflation, unexpected expenses, and economic uncertainty are common. If you’re determined to grow your savings this year, these personal finance tips to save more in 2025 will help you make smarter decisions, cut wasteful spending, and build a secure financial future.

Analyze Your Spending Habits

The first step toward saving more money is knowing where it currently goes. Review your bank statements from the last three months. Identify recurring payments, subscriptions, and unnecessary purchases. This clarity alone can lead to significant savings.

Create a Zero-Based Budget

A popular personal finance strategy in 2025 is the zero-based budget. This method allocates every dollar of your income to a specific purpose, ensuring no money is wasted. By assigning every dollar a job — even for savings or leisure — you stay in control of your finances.

Use Cash Envelopes for Discretionary Spending

Want to stop overspending? Withdraw cash for categories like groceries, eating out, or entertainment and use physical envelopes. Once the money is gone, no more spending in that category. It’s an old-school technique with proven results.

Automate Transfers to Savings

One of the smartest personal finance tips to save more in 2025 is automation. Schedule automatic transfers to your savings account on payday. This ensures saving becomes a habit and not something you’ll “try to do later.”

Cut Subscription Services You Don’t Use

From streaming platforms to fitness apps, it’s easy to accumulate monthly subscriptions. Cancel the ones you don’t use. Even if you’re only cutting $10 or $15 per service, it adds up over time.

Use High-Yield Savings Accounts

Instead of letting your money sit in a basic savings account earning less than 1%, consider high-yield savings options. These accounts can pay 4–5% APY in 2025, making your savings grow faster without any extra effort.

Cook at Home More Often

Dining out or ordering food regularly is a major expense. Preparing meals at home can save hundreds every month. Planning weekly menus and shopping with a list can double the savings.

Limit Impulse Purchases

Impulse spending is one of the biggest barriers to saving. Try the 24-hour rule: wait a full day before making any non-essential purchase. Often, the urge will pass, and you’ll save money.

Take Advantage of Cash-Back Apps

Use apps like Rakuten, Honey, or credit cards with cash-back rewards. These tools offer money back on purchases you’d make anyway. It’s a simple way to get paid while you shop.

Final Thoughts

With the right strategies, you can make 2025 your most financially secure year yet. These personal finance tips to save more in 2025 will help you build savings, reduce financial stress, and make smarter money choices — starting today.