What Is a High-Yield Savings Account?

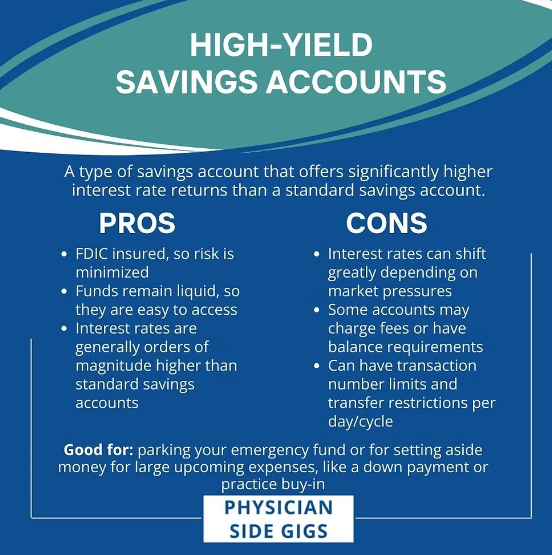

A high-yield savings account (HYSA) is a savings account that pays significantly more interest than a traditional one. While regular accounts may offer 0.01% APY, HYSAs typically pay over 4.00% APY, depending on the bank and market conditions.

These accounts are designed to help your money grow faster with little to no risk. They’re usually offered by online banks, which have lower overhead and pass the savings to customers through higher interest rates and fewer fees.

Why Choose a High-Yield Savings Account?

High-yield savings accounts are great for building an emergency fund, saving for big purchases, or simply earning more interest. The higher the APY, the faster your savings grow—even without making additional deposits.

Unlike stocks or crypto, HYSAs are federally insured and stable. They’re low-risk, making them perfect for conservative savers who want growth with safety. With compound interest, even small amounts can grow significantly over time.

Features to Look For in the Best HYSA

Always look for a competitive APY—4.00% or more is common in today’s market. Also, check for no monthly fees, no minimum balance requirements, and easy access to your money. These features ensure your savings grow without penalties.

Make sure the bank is FDIC-insured. This means your money is protected up to $250,000. Some banks also offer mobile apps, automatic transfers, and goal-tracking features, making it easy to manage and grow your savings consistently.

Best Online Banks Offering High-Yield Accounts

Ally Bank offers around 4.00% APY with no monthly fees or minimums. It’s well-known for excellent customer service and a clean user interface. Marcus by Goldman Sachs also offers competitive rates and useful savings tools.

Synchrony Bank and American Express® High Yield Savings accounts provide high APYs with solid reputations. Online-only banks often outperform traditional ones in this space. Always compare multiple banks to see which one matches your savings goals and habits.

How Interest Is Calculated and Paid

High-yield savings accounts use compound interest—interest that’s calculated not just on your deposits but also on the interest you’ve earned. Most banks compound daily and pay out interest monthly, which helps your money grow faster.

The APY reflects your true annual earnings, including compounding. If you deposit $10,000 at 4.00% APY, you’d earn around $400 in interest in one year—much better than the few dollars you’d get from a standard savings account.

Who Should Open a High-Yield Savings Account?

Anyone looking to grow their money safely should consider an HYSA. They’re great for students, working professionals, retirees, or anyone saving for short-term goals like a car, vacation, or emergency fund.

They’re also ideal for people who want a separate account to resist spending temptations. Having your HYSA separate from your main checking account makes it easier to save without dipping into the funds unnecessarily.

Tips for Maximizing HYSA Benefits

Automate your savings. Set up recurring transfers from your checking to your HYSA. This “set-it-and-forget-it” approach helps you stay consistent and builds your balance faster.

Also, don’t withdraw frequently. Most HYSAs limit the number of withdrawals per month. The fewer you touch your savings, the more interest you earn. Treat it as a long-term savings tool, not a daily spending account.

Things to Watch Out For

Watch out for promotional APYs that drop after a few months. Always read the terms carefully to ensure your rate is stable and long-lasting. Some banks also limit the number of monthly withdrawals—exceeding that may result in penalties or reduced interest.

Make sure there are no hidden fees. While most online HYSAs are fee-free, some may charge for paper statements, excessive withdrawals, or wire transfers. Choose an account that clearly outlines all costs and keeps your savings growing without deductions.

Final Thoughts on Best High-Yield Savings Accounts

High-yield savings accounts are one of the easiest and safest ways to grow your money. They offer far better returns than regular savings accounts with almost no risk, making them an ideal option for all types of savers.

Choosing the right HYSA can significantly boost your savings goals. Compare rates, check for fees, and pick a bank that fits your lifestyle. With the right account and consistent saving habits, you’ll be surprised how quickly your money can grow.